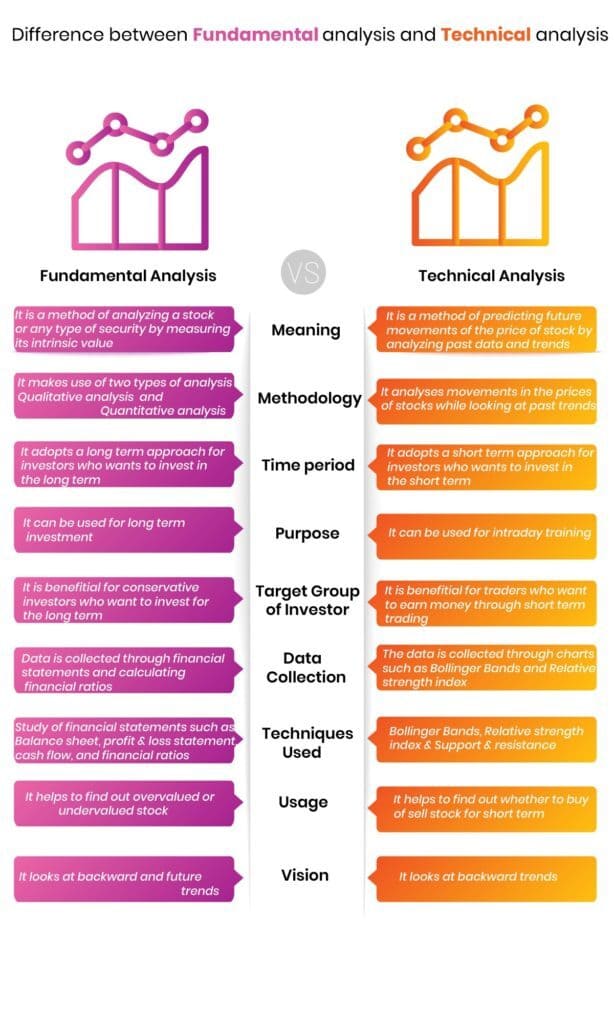

Difference Between Fundamental & Technical Analysis

So what is the difference between fundamental and Technical Analysis?

To ask which strategy is superior to one another would be an endless discussion. Both methods have proven to be highly effective when applied properly.

The main difference of the two strategies is that fundamental analysis determines the actual value of a stock or asset. Technical analysis determines the future price trend of a stock by using charts and graphs to identify patterns.

Fundamental analysis is commonly used for long-term investing purposes whereas technical analysis is preferred for short-term & swing trading.

For fundamental analysis the decision to buy or sell at a certain price is made based on all the data and performance that has been achieved from both the past and the present. For technical analysis the decision to enter or exit at the correct time will be made based on the market trends and prices of a stock that have occurred in the past.

Fundamental analysis VS Technical Analysis

Share

Recommended

How to Make Money With a Trading Bot? KuCoin Bot Guide

Technical Analysis Explained

Swing-Trading Explained

Trump’s World Liberty Financial: A Bold Move into DeFi

Trump’s Memecoin Shakes Up the Market: The Rise of $TRUMP

MiCA Regulations Reshape the Crypto Landscape: What You Need to Know

More Guides

How to create a Binance account

This guide will cover how to get started on Binance, 2-FA protection and more handy things to know before getting started trading. What is binance? Binance

How to create a Coinbase account

Cryptocurrency has become a hot topic over the last period of time. With the increasing amount of demand we are here to help you get started setting

DEX aggregator

DEX aggregators are financial protocols that enable cryptocurrency traders to access a wide range of trading pools via a single platform. On trading platforms you can select the desired trading

10 best crypto youtube channels to follow in 2021 !

The Cryptocurrency space is a fast moving and complicated industry that can be overwhelming sometimes. That is why following a cryptocurrency youtuber is an excellent way

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Avalanche

Avalanche  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  WETH

WETH  Litecoin

Litecoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Ethena USDe

Ethena USDe  Pepe

Pepe  Bitget Token

Bitget Token  Aave

Aave  Bittensor

Bittensor  Dai

Dai  Pi Network

Pi Network  Cronos

Cronos  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Ethena Staked USDe

Ethena Staked USDe  Internet Computer

Internet Computer  Ondo

Ondo  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL